how does the arizona charitable tax credit work

Get your tax refund up to 5 days early. In fact most households receive the EITC as a refund.

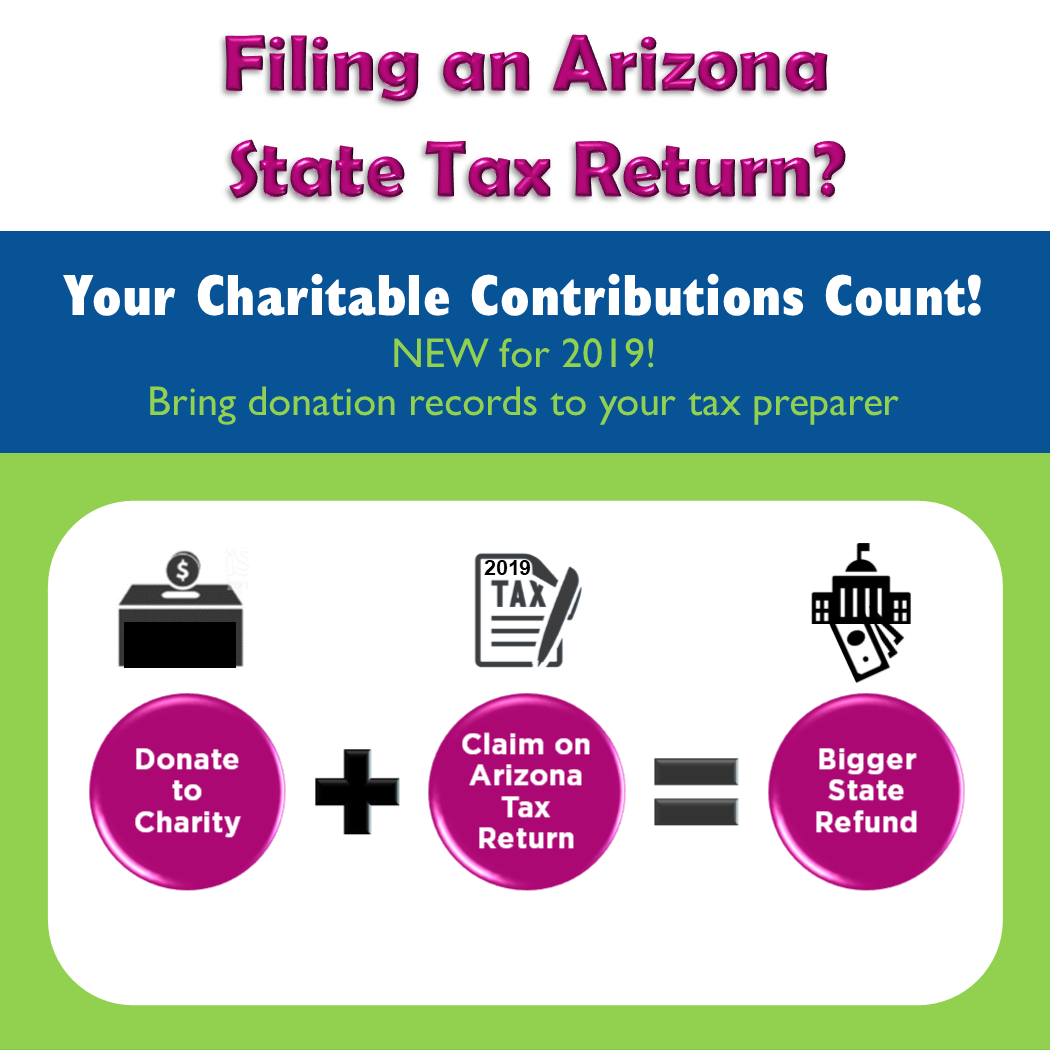

Charitable Contributions Count In Arizona Tempe Community Council

The Earned Income Tax Credit EITC for example is a fully refundable tax credit.

. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates. Like the Federal Income Tax Nebraskas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Benefits in tax season.

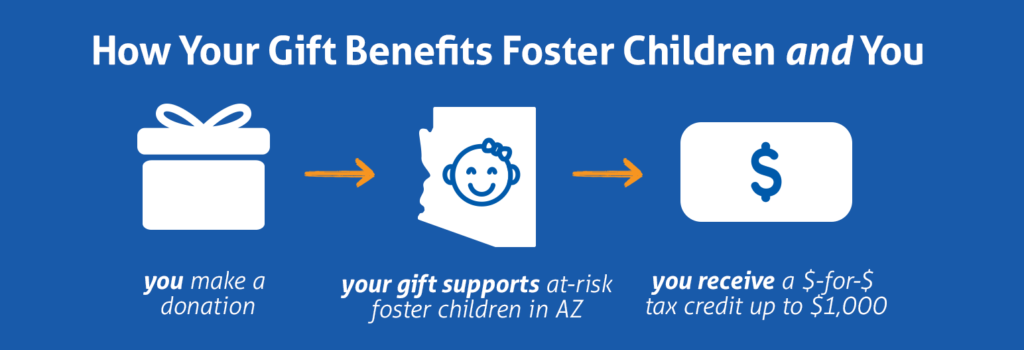

Taxpayers can also donate to a qualifying state foster care charitable organization the Arizona State. Arizonas maximum marginal income tax rate is the 1st highest in the United States ranking directly. In addition to tying for the sixth-lowest US.

When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early. Tax Credits Rebates Savings Page. You report the name of the Qualifying Charitable Organization you donated to as well as the dollar amount of your donation to the Department of Revenue on Form 321.

An individual income tax credit is available for contributions that provide assistance to the working poor. In 2016 273 million tax returns claimed the EITC for a total of 667 billion of which 571 billion was refunded. Nebraskas maximum marginal income tax rate is the 1st highest in the United States ranking directly.

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5. In contrast the 500 Child and Dependent Care Tax Credit CDCTC is nonrefundable. You must also total your nonrefundable individual tax.

Like the Federal Income Tax Arizonas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Property tax it also has low income tax rates does not tax Social Security income and has no inheritance tax and no estate tax below 116 million in value all of which make a hugely popular destination for. The credit is available only to individuals.

Nebraska collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Arizona collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

List Of 6 Arizona Tax Credits Christian Family Care

Arizona Tax Credits Mesa United Way

Qualified Charitable Organizations Az Tax Credit Funds

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Childrens Hospital Foundation

Give To Nac An Arizona Qualifying Charitable Organization Native American Connections

Tax Credit Central Arizona Shelter Services

Az Charitable Tax Credit Childrens Clinics In Southern Arizona

Arizona Charitable Tax Credit Donations St Mary S Food Bank

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Childrens Hospital Foundation